Welcome to the FemalExperts Podcast – Your podcast by women, for women, about women. In today’s podcast episode, I want to talk about the Gender Investment Gap. Here, I specifically focus on the financing of female startups. However, other financial topics and asset classes, such as stocks, bonds or cryptocurrencies will also be discussed, because after all, you can never talk about money enough.

What is the gender investment gap?

The gender investment gap is currently defined in two ways: On the one hand, the term describes the existing gap in investments in women-owned companies and, on the other hand, the lower investment activity of women compared to men. We devote ourselves here to the first approach and clarify why female founders and their ideas are not worth investing in.

Only 4 out of 100 startup founders receive venture capital

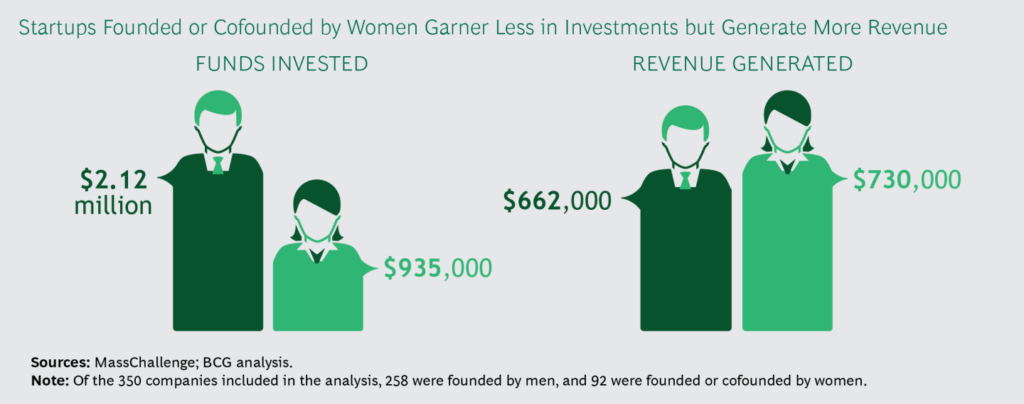

Let’s look directly at the numbers: 15.7% female founders in the startup scene receive only 4% of the venture capital distributed to startups, according to the Female Founders Monitor 2020. Makes me wonder: what’s wrong in the glitzy world of venture capital? Briefly by way of explanation for those who don’t live in the “start-up bubble”: start-ups are usually fast-growing companies that rely on outside funding. Since venture capital is not available, other financing options are used. The argument that women-owned businesses are less risk-averse is just as persistent as the fact that they are the wrong industries to start up in. If the majority of venture capital comes from male-dominated venture capitalists, then it is also reasonable to assume that they invest in industries with “risk-averse” men(keywords: unconscious bias and gender bias). Lack of risk awareness or the wrong choice of industry are thus bogus arguments. Especially since investing in women-owned businesses is more likely to pay off.

Why is it so difficult to get money as a start-up?

You can imagine that with an innovative, risky business model that’s in the startup phase, it’s hard to walk into a bank and ask for capital. For example, technology companies in particular have shown that positive business figures are definitely important, but growth is far more important. Therefore, startup founders are also dependent on external investors.

By the way: Not only because of their money, but also because of the know-how, contacts or experience they bring with them.

If you take a close look at this area of the investment industry, it becomes clear which factors are the stumbling blocks here:

- Too few female investors: 10% of all investors in Europe are female, so you are more likely to find yourself ahead of men in a funding round.

- “Women’s topics”: women more often start up in areas that are thematically difficult for men. Period underwear, an algorithm to find the right bra size or cosmetics are needed, but unfortunately they are not an attractive investment for traditional investors.

- Unconcious Bias / Gender Bias: As mentioned above, we cannot escape the unconscious bias, which is why we promote the projects and business ideas that we would start ourselves. Female projects still too often fall through the cracks.

- Purpose vs. capital: For women, factors such as “green economy” or “social entrepreneurship” play an important role. Unfortunately, many investors see a contradiction between a well-intentioned, positive and sustainable purpose and rapid scalability. Male-led startups that hold these values must face equally critical scrutiny, but they have the advantage of avoiding the other stumbling blocks.

- Workaholic mentality: There is still the Silicon Valley superstition of not only subordinating one’s diet, sleep, relationship and work-life balance to the start-up, but even sacrificing them. Due to “gender bias,” female founders are often not trusted to work through nights, endure stress, and make tough decisions. In addition, it is suggested that mothers cannot fully concentrate on the company in addition to raising children.

How can we address the status quo in the “gender investment gap”?

1. new role models

We ourselves are in demand when it comes to changing role models and breaking out of existing behavior patterns. We also model a certain reality of life for our children, and if my mother hadn’t worked and always suggested that my (financial) independence should be one of the most important factors in life, I don’t know if I would have even ventured down my path into entrepreneurship. This also applies to men/fathers: the message should be that there are no limits for the daughter (overcoming: “Be good, fit in, do something safe”, to: “Be brave, dare something and endure critical opinions sometimes”).

2. teaching in schools

Financial education or even projects focusing on entrepreneurship in schools are overdue. Children often associate money with consumption and independence with risk. These are completely one-sided connections that need to be expanded.

3. women in entrepreneurship

Women in the corporate scene must not be an exception, but must become a lived reality. This can only be done by the genders showing solidarity with each other, but also with each other. We must no longer suggest that successful women must have a deficiency somewhere or can no longer be feminine.

4. diversity

Fortunately, something is moving in part, albeit out of necessity: many companies are realizing that they can no longer reach their target groups in part because they no longer understand them. This leads to more diverse teams, more equality and a cultural change in the start-up scene.

5. politics

We already see with the women’s quota that so-called “voluntary commitments” achieve little or nothing. Measures and initiatives are needed that get to the root of the issue. Accordingly, specially launched support programs for female founders are a good idea to counteract the gap.

As you can see, there is still some catching up to do in the area of the “gender investment gap”. Things are already in motion and many ideas are already being implemented:

- Thus, there are more and more female investors who are coming forward and publicizing the issue

- There are a few financial magazines, such as Courage or Strive Magazine, that explore the issues in more detail

- And even in the scene itself, there is more talk about the lack of venture capital for women-led startups

I’d be very interested in your thoughts on this podcast episode – What’s your take? Have you ever come into contact with this issue or are you perhaps affected yourself? Feel free to get in touch with me, I’m looking forward to a mutual exchange!

Thanks for listening or reading

Your Kinga

Sources:

Fundright 2020: It’s time to fund right

Why Women-Owned Startups Are a Better Bet – BCG

About the author

Kinga Bartczak advises, coaches and writes on female empowerment, new work culture, organizational development, systemic coaching and personal branding. She is also the managing director of UnternehmerRebellen GmbH and publisher of the FemalExperts magazine .